Is Loyalty dead, or does it just need a defibrillator?

Is Loyalty dead, or does it just need a defibrillator?

Okay, so that is not entirely true. Customer loyalty isn’t really dead – it’s still a top priority for marketers and brands world over.

Only thing is, it’s vastly different now.

For one, brand-centric loyalty metrics like the recency, frequency, and monetary value (RFM) of customer spends aren’t relevant anymore. Instead, today, loyalty is all about how well your brand fits into each customer’s life, powered by emotions.

In 2021, if you want customers to continue buying from your brand, just showing up with good products or services isn’t enough. You need to offer additional value, and it has to be personalized to fit each individual customer.

Which brings us to the most important portion, “lifestyle marketing”.

In a world where technology has drastically altered consumer lifestyles, it is the panacea to your customer loyalty conundrum. It involves building brand affinity by offering content and experiences that your audience doesn’t want to live without. This is why, today customer loyalty can be built through wholesome experiences, enhanced by instant gratification and hyper-personalization.

But, first, let’s unpack the reasons for the evolution of customer loyalty to what it is today.

Why customers deserve their pound of flesh in the digital era

Today’s customers are a mobile-slinging, well-informed, and dynamic bunch. They are switching between channels, devices, and sites as they shop. At the same time, they are spoilt for choice, constantly being bombarded with targeted messaging, on their smart devices.

Technology has also lowered switching costs. So, while starting a new business and acquiring new customers has become easier, so has losing customers. Especially considering it costs 5 to 10x more to acquire a new customer, your efforts need to be focused on retaining loyal customers.

All of this has completely shifted the power dynamics. It’s the customers, and not brands, that wield the real clout and they are demanding their pound of flesh. They want a relationship that is more than just basic transactions.

To stay relevant, brands not only need to innovate beyond traditional offerings but also need to transform their loyalty programs into customer engagement engines. By embracing lifestyle marketing brands have started to place customer engagement at the core of any customer-brand touchpoint.

This is why you will find B2C and B2B2C businesses trying to become lifestyle brands. For instance, several insurers are venturing into fitness and wearables. Traditional banks are emulating a super-app-like ecosystem of digital lifestyle services within their banking apps or jumping on the Buy Now Pay Later (BNPL) bandwagon. Speaking of wagons, something core to people’s daily lives such as owning and fueling an automobile to move from point A to point B is shifting from a single price tag to a subscription-based service offering a lifetime of energy in form of battery swaps (electric cars).

But four fundamental questions remain!

1. What is the purpose of a business?

Contrary to popular opinion, brands shouldn’t be only about making profits and providing employment. These are merely by-products of doing business. Instead, your focus needs to be all about offering customers ‘real’ value by addressing their needs and solving their problems. The idea is to keep them constantly engaged. Ultimately, this value exchange creates a sense of emotional loyalty and shared purpose amongst your customers.

2. How to run loyalty programs right?

Loyalty programs have become a hygiene and a prerequisite. Today, successful loyalty programs run by Starbucks and American Express are considered the gold standard.

The only issue is that they are not very well thought-out. Mostly, they are just knee-jerk reactions to a competitor’s customer retention efforts.

To create loyalty programs that offer more strategic and long-term value to customers, you can follow these strategies:

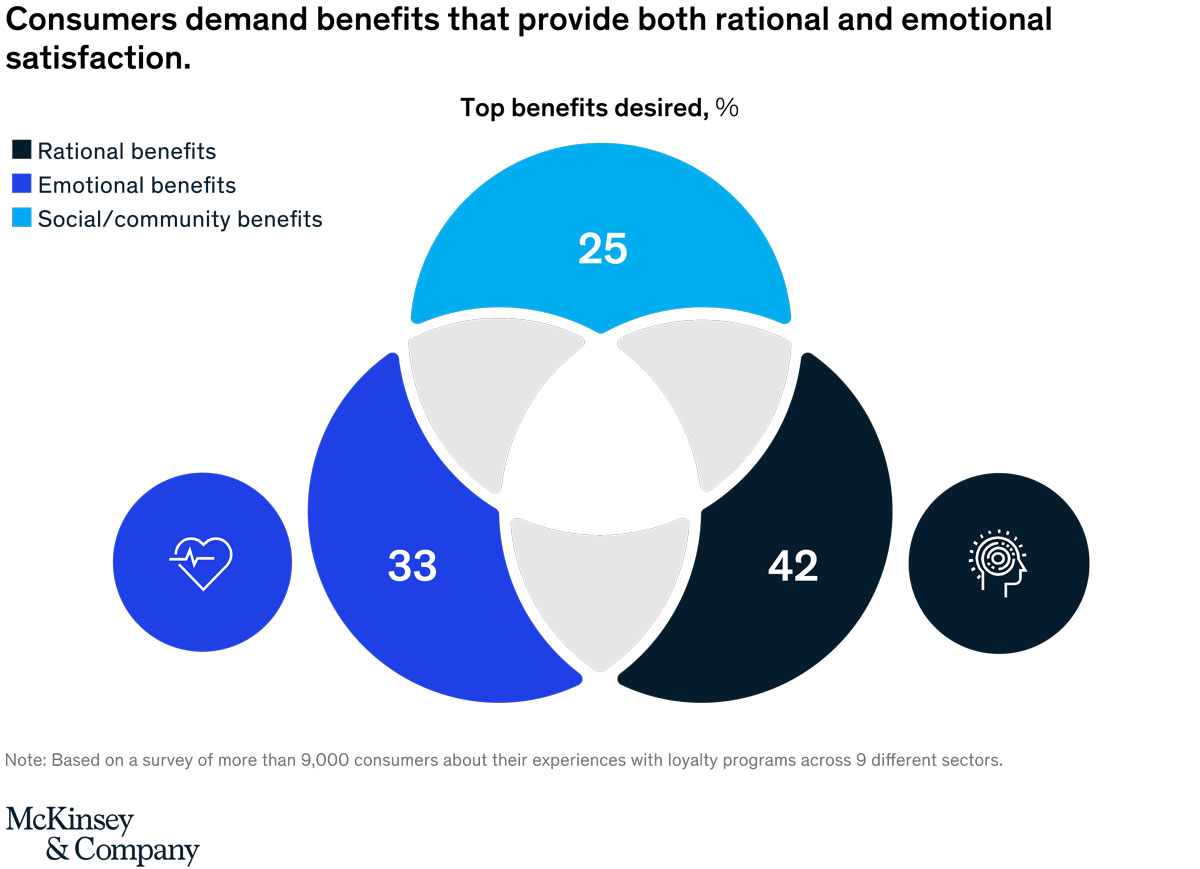

- Deliver additional customer value, be it functional, emotional, social, aspirational, or psychological, above and beyond the core offerings. Customers really value such add-on benefits. This is why ‘Paid Loyalty’ programs (like Amazon Prime) are becoming so popular.

- Harness customer data smartly to offer hyper-personalized and authentic appeals to the head and heart. Thus, actively giving customers a reason to earn and burn their loyalty points.

Source: McKinsey & Company – Preparing for loyalty’s next frontier: Ecosystems

- Balance monetary rewards with experiential offerings such as exclusive events and early access. After all, 72% of millennials prefer to spend on experiences vs products.

3. What is the purpose of customer engagement?

The goal of customer engagement is to secure top-of-mind recall for your brand. This can be achieved by delivering customer value through interactions across varied channels that strengthen the relationship with customers.

The only problem is, nowadays, the focus of customer engagement and loyalty programs have shifted AWAY from customer value. Customer engagement strategies are disjointed from consumer lifestyles.

Luckily, Perx lifestyle marketing solutions resurrect loyalty as a concept for brands. We help by building data-driven engagement opportunities, targeting customers, and rewarding their actions. Growth in customer engagement rate by up to 6 – 12x compared to what you are experiencing now with traditional digital marketing.

4. What exactly is customer value?

Customer value is the satisfaction a customer experiences (or expects to experience) by taking an action relative to the cost of that action. To deliver real customer value, be sure to get regular customer feedback. Find out what the customer considers important and deliver better on these factors than the competition.

Tying all of it together

Any customer engagement strategy or loyalty program has to be centered around consumers’ lifestyles. Why? Because as individuals and as a society, our needs have evolved over time from the tier-1 physiological needs to the more sophisticated cognitive and self-actualization (emotional) needs.

Source: 1 Maslow’s Hierarchy of Human Needs

SaaS and getting to a state of viability fast

SaaS and getting to a state of viability fast

This honour and the validation that comes with it has only reinforced our belief in the product we’ve built and the mission it is committed to –

This honour and the validation that comes with it has only reinforced our belief in the product we’ve built and the mission it is committed to –

Remember Sears? The once major american retail brand, which quite literally changed the way people shopped, Sears today is cash-starved and struggling to keep it’s less-than-1000 stores worldwide operational. Industry experts say that the biggest reason the incumbent stumbled to this low is that it failed to renovate its revenue model in the light of the advent of online shopping.

Remember Sears? The once major american retail brand, which quite literally changed the way people shopped, Sears today is cash-starved and struggling to keep it’s less-than-1000 stores worldwide operational. Industry experts say that the biggest reason the incumbent stumbled to this low is that it failed to renovate its revenue model in the light of the advent of online shopping.

Shortlisted by a panel made up of the top VCs, long-standing entrepreneurs and heads of leading corporates of the world, Perx was lauded for its innovative use of AI for

Shortlisted by a panel made up of the top VCs, long-standing entrepreneurs and heads of leading corporates of the world, Perx was lauded for its innovative use of AI for

This was my first such outing with ‘Team Perx’ (I’d joined as the head of talent only 3 months earlier). I work out of Australia, so this offsite, which took place in the wonderful setting provided by the Turi Beach resort, was going to be my first in-person interaction with the corporate team that works out of our main Singapore office.

This was my first such outing with ‘Team Perx’ (I’d joined as the head of talent only 3 months earlier). I work out of Australia, so this offsite, which took place in the wonderful setting provided by the Turi Beach resort, was going to be my first in-person interaction with the corporate team that works out of our main Singapore office. For one, the nature of this congregation was rather unique. The locus of a lot of the conversations right from the start of the offsite was individual impact and how it affects the larger creature that is the organization. For what it’s worth, I think this was the first time I found a company peering beyond company goals and action plans to talk about how its individuals perceived the company and navigated goals on a daily. And while not unusual, it’s certainly uncommon to stumble upon such conversations at work, let alone at an end-of-the-year offsite

For one, the nature of this congregation was rather unique. The locus of a lot of the conversations right from the start of the offsite was individual impact and how it affects the larger creature that is the organization. For what it’s worth, I think this was the first time I found a company peering beyond company goals and action plans to talk about how its individuals perceived the company and navigated goals on a daily. And while not unusual, it’s certainly uncommon to stumble upon such conversations at work, let alone at an end-of-the-year offsite